PAYGINE — Transformation of Traditional Banking into a Global Banking Service

Greetings to friends, here I will talk about the Paygine project or the future future platform, designed for work within my own banking structure, and this project is based on the reliable Crypto business.

Paygine is an open financial platform designed to serve FinTech and crypto-economic needs in money transfers, currency exchange and the payment of “real” goods and services within the White Label solution.

Based on the needs of international banks and financial organizations, the founder of Best2Pay, decided to create a new platform. The main competitive advantage of PayTraining is that it can not be used in any other way.

The Paygine platform will offer the following services using the existing Best2Pay technology:

- Transfer of a crypto currency to / from a bank card;

- Pay in shops and shops using cards in crypto currency;

- Receipt of crypto currency as payment for goods and services in the online store;

- Transfers a cross-border currency using crypto-currency at a minimum cost;

- Maintaining wallets in both currencies is fiat and cryptocurrency with the ability to easily and easily convert funds between them.

Best2Pay and was established in the United States of America, SEB, Raiffeisenbank, Bank St. Petersburg. Petersburg. Petersburg, Russian Standard Bank and Sberbank.

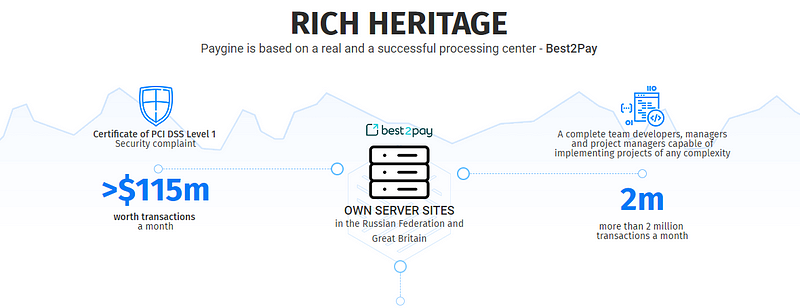

Best2Pay services use projects from finance and e-commerce to serve more than 1.5 million subscribers, increasing by 34% each month.

The Best2Pay platform allows you to implement projects of any complexity that will take into account the unique capabilities of the client’s business processes, infrastructure and client target customers.

BEST2PAY — LEADER MARKET FOR PAYMENT ONLINE AND TRANSLATION

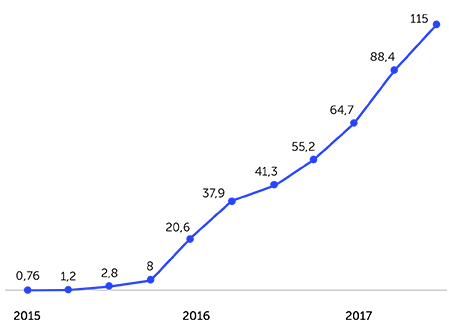

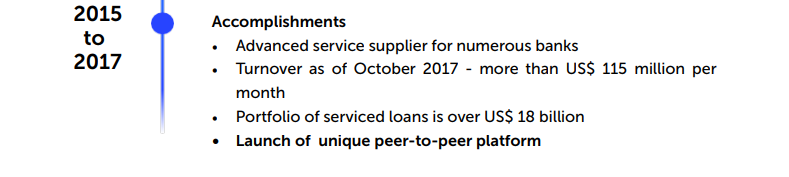

Best2Pay monthly income, repayment of loans and the transfer of peers-2-Peer for 2015–2017 (USD)

We came up with the idea of building an open financial platform that includes our bank in 2017. At that time, together with our partners, we launched a Bitcoin money transfer system for money transfers from the USA to Mexico. We developed an IT system, solved all legal issues, with the help of a lawyer, and obtained legal opinion, which confirms the legality of the operation and actions.

It seems that just one small thing — to find a bank for cooperation. As soon as they find out that we will use Bitcoin as a method of payment, the bank will immediately reject us, regardless of all the documents submitted and legal opinions. We faced the same problem when we tried to organize the last money transfer service in Europe. All decisions are too complex — with many intermediaries — and do not guarantee a smooth operation for more than 1 or 2 months, even considering that, in addition to the legal opinions, we comply with all requirements for AML / TRC. But it does not help. Banks and financial institutions just to hear with “bitkoyn”, for no reason!

The second thing is that we can not afford all the services that we do not have. need through the API. This led to the fact that our customers are directly connected with our partners.

As we know later, more than 79% of FinTech and CME-related crypto startups are struggling with these two problems. At present, according to various estimates, the total amount of money, the amount of money,

That’s why we decided to offer something fundamentally new for the market.

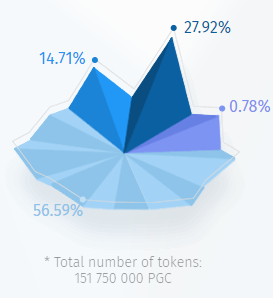

DISTRIBUTION OF TOKENS

and projected use of income

Name and logo of the marker: PGC

Price: 1.00 PGC = 1.00 USD

Blokach: Ethereum, ERC20

Use of tokens: after the launch of the project, each holder will have the right to pay for goods or services using tokens in the ratio 1 PGC = 1 USD.

All unsold token will be sent there for use on the Paygine platform in the future.

The tokens distributed among the investors of the project will be

41,508,000 PGC (27.92%)

Tokens distributed among the members of the project team will be

22,500,000 PGC (14.71%)

Dedicated to backup tokens

87,742,392 PGC (56.59%)

Tokens retire

1 191 608 PGC (0.78%)

Scheme of distribution of funds:

- Purchase of a bank (64.9%)

- Staff (18.3%)

- Legal expenses (registration, license, consultations) (4.8%)

- Operating costs (0.3%)

- Rent (1.3%)

- Acquired software and its settings (10.3%)

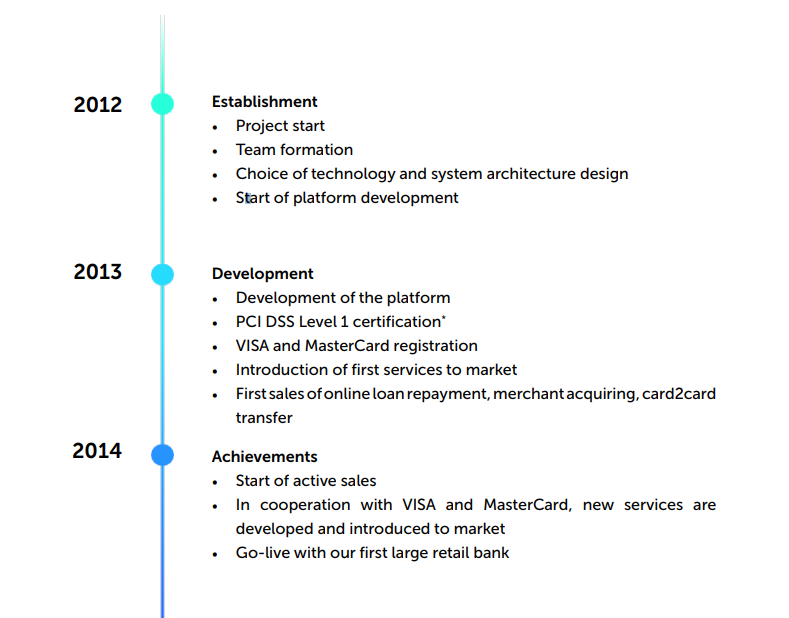

SCHEDULE

Watch a video about tokens

At the top of the page, I recommend below:

WEB SITE: https://www.paygine.com/

TELEGRAM: https://t.me/paygine_official

FACEBOOK: https: // www.facebook.com/paygine/

TWITTER: https://twitter.com/paygine

Link: https://bitcointalk.org/index.php?action=profile;u=1929500

Tidak ada komentar:

Posting Komentar