ENTRY

a blockchain-based banking service designed to increase the flow of cryptocurrency in the real economy.

What is ENTRI?

ENTRY is a blockchain based banking service designed to increase the flow of cryptocurrency in the real economy. This is a multi-utility financial platform empowered by AI. ENTRY is designed to allow people to use fiat and crypto currency in their everyday purchases without really having to care about the technology behind the system. ENTRY imagines being the real global bank in the post-fiat world. The entire framework is structured to improve the utility of all crypto. The ENTRY product package allows it to touch the financial life of each crypto user and change it for the better.

Why ENTRY?

Why ENTRY? The global financial crisis presents significant weaknesses in the existing financial system and some vulnerabilities have shown their impact on interconnected global markets. The world economy is still struggling with the sluggish real growth of today. Transferring money for remittances, borrowing money on international borders is still very complicated, time consuming and expensive. The existing system that runs on traditional banking channels is slow and full of intermediaries, higher exchange rates, opponent risk, bureaucracy and extensive documents9. The ENTRY business model is focused on disrupting existing financial pillars that only act as toll-keepers without adding value to consumers and businesses.Deleting multiple intermediaries will make the system faster,

ENTRY is a blockchain based platform powered by smart contracts; it is not a deposit, the easiest payment and loan service, cross border payments, ATM / withdrawal facilities are easy, but also as a currency exchange for businesses and consumers.

Mission Statement:

Mission Statement: To be the gateway between paradigm and traditional and new financial systems led by cryptocurrency and empower the financial ecosystem to have a framework that enables interoperability between the two. We aim

To help cryptocurrency achieve secrecy and transparency of the crypto finance world to every citizen.

To keep transparent records of all transactions in the ecosystem.

To expand the use of cryptocurrency for purchases and payments around the business world.

To create a simple and versatile platform to revolutionize traditional methods of handling the banking system.

Comprehensive package of products and services of ENTRY will ensure new standards in banking and financial services.

MARKETING PROBLEMS AND SCENARIOS

MARKETING PROBLEMS AND SCENARIOS The 2008-2009 financial crisis has left the general public losing confidence in the global banking system. Bitcoin, a cryptocurrency developed by a person or group of people named Satoshi Nakamoto. The loss of confidence in the bank led to the emergence of a peer-to-peer “no-confidence” electronic money system based on a technology called blockchain.

THE INTERMEDIARY WILL FADE AWAY The

THE INTERMEDIARY WILL FADE AWAY The fundamental value proposition of blockchain is that it eliminates the need for trust – a commodity without which a value exchange (transaction) can not occur. This means that individuals and businesses can get rid of the many intermediaries they pay for managing trust. 2

Bitcoin is just one application of new technology (blockchain). The emergence of cryptocurrency has led to an explosion in which new innovations are being built on the structure through pioneering Tokken crypto to disrupt existing traditional industries.

SURGE IN CASHLESS PAYMENTS The

SURGE IN CASHLESS PAYMENTS The volume of global non-cash transactions grew 11.2% during 2014-2015 to USD 433.1 billion, the highest growth in the past decade. Debit cards and credit card transfers are the leading instruments by 2015, while the use of checks continues to decline globally. Debit cards accounted for the highest share (46.7%) of global non-cash transactions followed by credit cards with 19.5% by 2015.

The RBR (Retail Banking Research) study shows that the share of credit transfers has also increased. They tend to be used for high-value payments, such as salaries and business-to-business payments, and reach 89% of the value of payments without cash.

The impressive growth of impressive moneyless transactions will continue, with more and more cards being used for low-value payments, supported by the spread of contactless cards and the EFTPOS terminal. Meanwhile, the growth of credit transfers is aided by the enabling system implementation.

service ENTRY

service ENTRY

Entry.Money

Cryptocurrency business model and fiat payment gateway for e-shop. Personal and business accounts (deposits,

withdrawals, instant cryptocurrency transfers & fiat). Web and Mobile app versions. Debit card.

Cryptocurrency business model and fiat payment gateway for e-shop. Personal and business accounts (deposits,

withdrawals, instant cryptocurrency transfers & fiat). Web and Mobile app versions. Debit card.

Cryptocurrency Entry.Exchange is

centralized and ultra-fast and instant P2P. High security standards,

world-friendly services and support for beginners around the world.

centralized and ultra-fast and instant P2P. High security standards,

world-friendly services and support for beginners around the world.

Entry.Network

Open source code, wallet, custom blockchain, smart contract, and custom platform token creation

.

Open source code, wallet, custom blockchain, smart contract, and custom platform token creation

.

Sign in. Blockchain Bank technology

enables fast and uncomplicated cross-border payments at very low cost.

enables fast and uncomplicated cross-border payments at very low cost.

Cash Entry / Cash

system / ATM machine . Transfer, cash out or top up with cash (using an agent or cash machine).

Payment Gateway for POS (real shop, service provider). It will also appear to have a payment card in

the future for easy access to fiat and crypto.

system / ATM machine . Transfer, cash out or top up with cash (using an agent or cash machine).

Payment Gateway for POS (real shop, service provider). It will also appear to have a payment card in

the future for easy access to fiat and crypto.

Token Entries

Will be used in the ENTRY platform as the main digital currency. Used in other platforms as primary cryptocurrency or not

. Can be exchanged for exchange.

Will be used in the ENTRY platform as the main digital currency. Used in other platforms as primary cryptocurrency or not

. Can be exchanged for exchange.

ICO ENTRY

ICO ENTRY

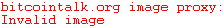

Details of LOGOEN Tokens are electronic and virtual currency tokens that will flow in the ENTRY ecosystem. This is the Token currency of the ENTRY platform used for peer-to-peer transactions and micro payments. This will be a medium of exchange for transacting on the platform and utilizing ENTRY’s banking and financial services.

Before the launch of the ENTRY platform, will undergo sales training Token. Funds collected in

ICO will be used by the team to develop the ENTRY platform.

Ticker Symbol ENTRY

Token Background based on ERC-20

Utility Token Type of

Sale Date Token 17 April – 17 July 2018 (Temporary)

KYP / AML Required For all ICO participants before or after

purchase

United States Limited (Please check your previous State Laws

Participate)

SOFT CAP 25,000,000 ENTRY / 2.500.000 EUR

HARD CAP 325.000.000 ENTRY / 80,500,000 EUR

Status of MVP Ready

TEAM Project Ready for

Money Institution Licenses Ready to

Currency

Received for ICO Fiat Currency: EUR, USD, Cryptocurrency Debit Card: ETH, BTC, BCH, LTC, DASH,

and more

Total ENTRY Coins 590,000,000 million

ICO will be used by the team to develop the ENTRY platform.

Ticker Symbol ENTRY

Token Background based on ERC-20

Utility Token Type of

Sale Date Token 17 April – 17 July 2018 (Temporary)

KYP / AML Required For all ICO participants before or after

purchase

United States Limited (Please check your previous State Laws

Participate)

SOFT CAP 25,000,000 ENTRY / 2.500.000 EUR

HARD CAP 325.000.000 ENTRY / 80,500,000 EUR

Status of MVP Ready

TEAM Project Ready for

Money Institution Licenses Ready to

Currency

Received for ICO Fiat Currency: EUR, USD, Cryptocurrency Debit Card: ETH, BTC, BCH, LTC, DASH,

and more

Total ENTRY Coins 590,000,000 million

Roadmap

Roadmap

Development 2015-Get started and earn Money Institution License.

The 2017 agreement was signed with the central bank to obtain SWIFT and IBAN numbers to link the SEPA system of the European Union.

2017-Developed payment gateway (credit / debit card, bank link, and more) to raise funds for online stores.

Integration 2017 -Start with the Central Bank system to provide peer-to-peer payments to all EU banks and start building infrastructure for international payments.

The crypto-exchange version and beta 2017-Start will be ready before ICO or during ICO.

2017 Meeting-Host with a card issuer for MasterCard or Visa cards issued to ENTRY users and invest more than 1 million Euros for sustainable platform development.

2018 (1st through 3rd Quarter) – Begin developing Pre-ICO and ICO. During ICO we will launch a payment gateway (ENTRY.MONEY) with a bank account for personal use. We will launch a crypto exchange (ENTRY.EXCHANGE).

2018 (4th Quarter) – Financial Institution license form (already obtained) for Electronic Money License or European Bank License. Begins obtaining financial licenses outside the EU to operate worldwide.

Service 2019 (2nd Quarter) -Expand (ENTRY.MONEY) adds business accounts worldwide and launches applications.

Wallet 2019 (Third Quarter) – STOP (ENTRY.NETWORK) to store, send, receive your crypto, participate in ICO via wallet. Blockchain (self or partner).

2019 (4th Quarter) – Starts P2P Loan (ENTRY.BANK).

2020 (2nd Quarter) – Launch ATM System (ENTRY.CASH) and install cash machine for beta testing.

2020 (3rd Quarter) – Partner with agents to provide deposit and withdrawal services with cash.

2021 (continued) – Investment, loans and other banking and financial services worldwide.

The 2017 agreement was signed with the central bank to obtain SWIFT and IBAN numbers to link the SEPA system of the European Union.

2017-Developed payment gateway (credit / debit card, bank link, and more) to raise funds for online stores.

Integration 2017 -Start with the Central Bank system to provide peer-to-peer payments to all EU banks and start building infrastructure for international payments.

The crypto-exchange version and beta 2017-Start will be ready before ICO or during ICO.

2017 Meeting-Host with a card issuer for MasterCard or Visa cards issued to ENTRY users and invest more than 1 million Euros for sustainable platform development.

2018 (1st through 3rd Quarter) – Begin developing Pre-ICO and ICO. During ICO we will launch a payment gateway (ENTRY.MONEY) with a bank account for personal use. We will launch a crypto exchange (ENTRY.EXCHANGE).

2018 (4th Quarter) – Financial Institution license form (already obtained) for Electronic Money License or European Bank License. Begins obtaining financial licenses outside the EU to operate worldwide.

Service 2019 (2nd Quarter) -Expand (ENTRY.MONEY) adds business accounts worldwide and launches applications.

Wallet 2019 (Third Quarter) – STOP (ENTRY.NETWORK) to store, send, receive your crypto, participate in ICO via wallet. Blockchain (self or partner).

2019 (4th Quarter) – Starts P2P Loan (ENTRY.BANK).

2020 (2nd Quarter) – Launch ATM System (ENTRY.CASH) and install cash machine for beta testing.

2020 (3rd Quarter) – Partner with agents to provide deposit and withdrawal services with cash.

2021 (continued) – Investment, loans and other banking and financial services worldwide.

For more information, visit the following link:

For more information, visit the following link:

Tidak ada komentar:

Posting Komentar