CEYRON

EXCHANGE SYSTEM ONLINE

The advancement of the financial industry and blockchain is now in doubt. For that required token that can combine both. Ceyron Finance Ltd (hereinafter referred to as "CFL"), intends to bring together the financial industry expertise and revolutionary blocking technology. CFLs interfere with two different worlds: Cryptocurrency, and Financial services.

www.ceyron.io will be a cryptocurrency -based investment platform with cryptocurrency trading terminal, debit card capability, and offer token backed by secured credit assets.

Ceyron Token are ...

Token is something that can be used instead of money. The CEY token is a digital token to be provided to the investor and is a vested interest in a separate class of non-voting equity shares in Ceyron. The CEY Token is a functional utility smart contract within the Fund. The CEY Token is non-refundable. It is not for speculative investment.

Ceyron Finance Sarl (CFS), is a Limited Liability Company incorporated under the Limited Liability Company Act ("Dana"), and is wholly owned by Ceyron Finance Ltd. The CFL and IMF have signed an Operation Agreement which sets out the rights and obligations of each party.

The funds will be managed and advised by Colombus Investment Management Ltd, ("Investment Manager"). Colombus Investment Management Ltd, is a British Virgin Islands listed as an independent alternative investment management company specializing in alternative assets and global asset allocations. The Fund Manager will be responsible for the operation of the Fund and will perform all services and activities related to the management of the Fund's assets, liabilities and operations.

Investment Objectives and Strategies The objective of IMF investments

is to provide attractive returns on invested capital through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd. The IMF will adhere to data-driven investment strategies, where machine learning in non-parametric statistical models is fully applied to the expected financial benefits of investment.

is to provide attractive returns on invested capital through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd. The IMF will adhere to data-driven investment strategies, where machine learning in non-parametric statistical models is fully applied to the expected financial benefits of investment.

The net income earned by the Fund during a particular month will generally be retained for reinvestment, but a portion of potential periodic revenue may be used to distribute annual dividends to holders of CEY Token, whereby the dividends are approved by the shareholders and CFL shareholders.

Credit Portfolio Support Token To Provide Lower Volatility and Cash Flow

The portfolio of credit assets will then be secured by a guarantee to improve stability and return. Fund managers will use artificial intelligence and machine learning to build a secure asset loan portfolio.

Blockchain Technology Enables Efficient Liquidity for Investors

Blockchain technology has the potential to provide greater integrity, security, security and transparency. Thus, CFLs will use blockchain to ensure immediate deal handling at low cost in the hope of providing greater liquidity to investors.

Blockchain technology has the potential to provide greater integrity, security, security and transparency. Thus, CFLs will use blockchain to ensure immediate deal handling at low cost in the hope of providing greater liquidity to investors.

Efficient Prepaid Debit Card

The account holder will be authorized to choose from multiple cryptoes for tender, and when making transactions (eg dinner at a cost of $ 83.65), prepaid debit debit money will be used, or the holder may elect to use a supported crypto, which will then be sold at a spot price to complete the transaction.

The account holder will be authorized to choose from multiple cryptoes for tender, and when making transactions (eg dinner at a cost of $ 83.65), prepaid debit debit money will be used, or the holder may elect to use a supported crypto, which will then be sold at a spot price to complete the transaction.

Competitive Costs

Since the CFL will hold both cash and a series of crypts at all times, it will be able to facilitate a smooth cash transfer in Crypto to facilitate transactions, and will enable CFLs to compete with Coinbase on services and fees.

Since the CFL will hold both cash and a series of crypts at all times, it will be able to facilitate a smooth cash transfer in Crypto to facilitate transactions, and will enable CFLs to compete with Coinbase on services and fees.

CFL Launches to Market Grows Market

for emergency cryptoes has grown over one hundred and sixty billion USD ($ 160 billion) in the past year. Financial giants and the Central Bank have both invested in blockchain technology. Both large and small investors are looking for a more orderly market that allows safety nets and insurance coverage to be offered in the registered security market.

for emergency cryptoes has grown over one hundred and sixty billion USD ($ 160 billion) in the past year. Financial giants and the Central Bank have both invested in blockchain technology. Both large and small investors are looking for a more orderly market that allows safety nets and insurance coverage to be offered in the registered security market.

Statement Issues For a World Developing a Developing

Population (Southeast Asia, Latin America, and Africa) numbering more than 2 billion people. Africa alone represents 1.2 billion people. It's young and dynamic: 60% are under 50.

Population (Southeast Asia, Latin America, and Africa) numbering more than 2 billion people. Africa alone represents 1.2 billion people. It's young and dynamic: 60% are under 50.

Banks are increasingly adopting mobile banking to:

- developing online banking services;

- take digital advantage for parties to integrate millions of people into the formal financial sector;

- develop merchant payment services.

The banking level is low

According to experts, more than 2.5 billion low-income and / or middle-income people are not associated with banks. Traditional agency models easily meet the needs of the poorest but no longer fully meet the requirements of banks.

The reason for low banking penetration is at two levels.

- At the client level: most people only have low or very low income, and thus save low capacity. While economic monetization has increased significantly since the 2000s, bank use has not been part of spontaneous practice. The emergence and rapid growth of powerful microfinance companies radically changed this situation.

- At the bank level: the relative excess liquidity of banks is not an incentive for customer development. Weak population density adds to the average cost of the implementing agency.

A very competitive market

More than 75% of countries have the majority of services where mobile money services are available. This increased competition means that consumers have more choices. Some subscribe to two or three services simultaneously.

Very low usage rate

Africa is the world leader in mobile money account 2% of adults have mobile money accounts in the world, 12% of holders are in Africa. Every year the number of open mobile money accounts increased by an average of more than 40%. By 2020, the number of Africans with discretionary income - nearly 450 million people - will be comparable, if not superior to Western Europe with an average growth rate of 20% per year. By 2020, there will be nearly 800 million people who have mobile money accounts. Generates potentially nearly 10 billion transactions per day worth almost $ 135 billion dollars by 2020.

Africa is the world leader in mobile money account 2% of adults have mobile money accounts in the world, 12% of holders are in Africa. Every year the number of open mobile money accounts increased by an average of more than 40%. By 2020, the number of Africans with discretionary income - nearly 450 million people - will be comparable, if not superior to Western Europe with an average growth rate of 20% per year. By 2020, there will be nearly 800 million people who have mobile money accounts. Generates potentially nearly 10 billion transactions per day worth almost $ 135 billion dollars by 2020.

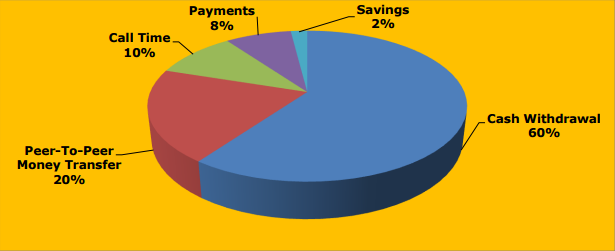

User behavior analysis of means of payment appears to be a general trend: the withdrawal represents at least 60% of the volume of transactions; peer-to-peer diversion operation 20%; buy call time 10%; 8% payment and 2% savings.

Shy cries through bank cards holders of CEY card tokens will be privileged to receive their annual dividends on their CFL cards.

The lack of safe and unsecured credit for CFL credit applicants

has the intention to resolve this issue in Africa where there is a lack of credit available to most applicants. More specifically, the dividends distributed to holders of CEY tokens will enable them to qualify for credit because dividends can be considered as a source of revenue.

has the intention to resolve this issue in Africa where there is a lack of credit available to most applicants. More specifically, the dividends distributed to holders of CEY tokens will enable them to qualify for credit because dividends can be considered as a source of revenue.

In Africa, there is a steady and persistent lack of income in credit applications.

CFL Solutions

CFL Credit Portfolio

Currently, sixty percent (60%) of US mortgage loans are held by non-banks, up from thirty percent (30%) in 2013. More than four trillion USD ($ 4T) in US mortgages alone is available for selected hundreds of non-bank credit platforms. The Investment Manager is tasked with approving solvency and risks associated with the platform itself and identifying the credit profile of the originating asset, from the regulatory compliance regarding origination, volume, collateral, duration, and interest rate, on the quality of management and service. Fund Managers will be tasked with selecting the highest performing assets available in this platform for the CFL portfolio, as well as cleaning up the highest risk assets of the CFL portfolio.

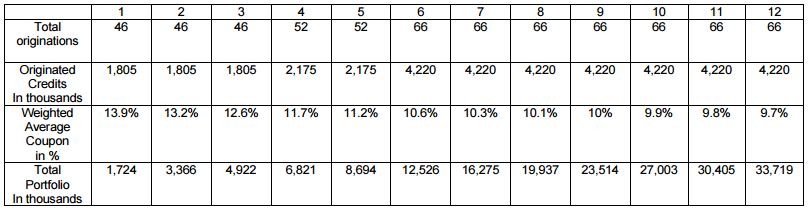

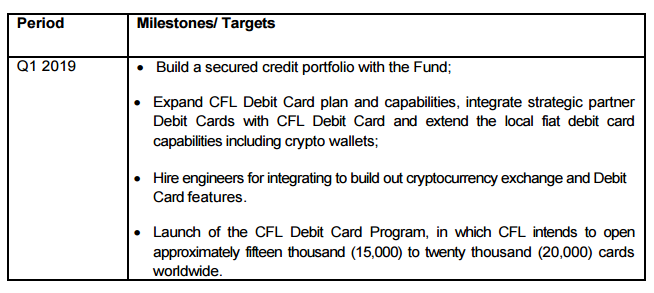

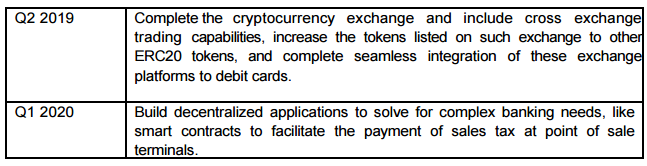

Investment Road Map

CEY Card The CEY card

will become a physical, virtual, and debit MasterCard with a mobile application that enables the use of twenty (20) foreign currency from one card. CFLs can save customers up to seventy percent (70%) for these costs. Currency can be exchanged at either point of sale (industry average is 3.75% versus 3% fee for CFL), and also through applications. In addition, unlike the standard 1.5 percent fee for ATM withdrawals, CFLs will not assess ATM withdrawal fees. The CFL mobile app will contain additional functionality to transfer funds in currency between merchants, as well as friends and family accounts, thus earning money at zero percent (0%).

will become a physical, virtual, and debit MasterCard with a mobile application that enables the use of twenty (20) foreign currency from one card. CFLs can save customers up to seventy percent (70%) for these costs. Currency can be exchanged at either point of sale (industry average is 3.75% versus 3% fee for CFL), and also through applications. In addition, unlike the standard 1.5 percent fee for ATM withdrawals, CFLs will not assess ATM withdrawal fees. The CFL mobile app will contain additional functionality to transfer funds in currency between merchants, as well as friends and family accounts, thus earning money at zero percent (0%).

CFL Card plans to have a Partner for expenditure management. This will enable the integration of mobile apps for easy management of travel travel and links to many travel partners for e-acceptance management. In short, CFL cards will be developed to provide liquidity upgrades to one of the twenty (20) global currencies as well as the main crypto currencies.

CFLs and Blockchain

Cryptocurrency (or crypto currency) are digital assets designed to work as a medium of exchange that uses cryptography to secure transactions, to control the creation of additional units, and to verify asset transfers.

Cryptocurrency (or crypto currency) are digital assets designed to work as a medium of exchange that uses cryptography to secure transactions, to control the creation of additional units, and to verify asset transfers.

Cryptocurrency is designed as a method for decentralized transactions with values held in rare digital goods. This is very interesting in communities where governments make their currency worthless through hyper-inflation. Today, fifty percent (50%) of people worldwide have bank accounts. By 2014, it is sixty-two percent (62%), and cryptococcus takes a greater foothold among the unlenderable. Cryptocurrency is designed as a method for decentralized transactions with values held in rare digital goods. This is very interesting in communities where governments make their currency worthless through hyper-inflation. Today, fifty percent (50%) of people worldwide have bank accounts. By 2014, it is sixty-two percent (62%), and cryptococcus takes a greater foothold among the unlenderable.

The fiat currency market becomes a new cryptocurrency operating for several years. Illustration of the current maturity level of the industry is a relatively large difference between the prices in the fiat currency of Bitcoin on various major exchanges.

Blockchain technology is still young, but it has proven its ability as a big book that can not be changed. Bitcoin is a sign that is speculative, and its value, like diamonds or gold, beyond industrial use, is entirely driven by scarcity and assurances to its holders that this item is unique and ready to trade.

CFL Safety Token

- CFL intends to grant, but does not guarantee, a token holder with an annual dividend, which must be approved by the Board of Directors and the voting shareholder.

- CFL intends to invest eighty-five percent (85%) of the proceeds received by the CFL from this Funding Offer, and the IMF will in turn invest in credit assets, thus seeking to create stable and growing cash flow resulting in the basis of CEY Token cash can not be guaranteed, and may be affected by market conditions and regulations)

- CFL intends to use simple leverage to further increase the profitability of its loan portfolio to facilitate ongoing and sustained investment to improve the credit portfolio underlying the CEY Token (enhanced yields can not be guaranteed, and may be affected by market and regulatory conditions)

- CFLs will enhance their ability to build their loan portfolios with leverage by providing their warehouse creditors as collateral for credit guarantees.

- CFLs intend to maintain cash, securities and token reserves at all times to ensure the liquidity of holders of CEY Token (Liquidity of assets can not be guaranteed, and may be affected by market and regulatory conditions).

- CFLs will enter into an alliance with a security provider that will be used to reduce the risk of total capital loss. However, the use of these financial instruments is not a guarantee against any and all possibilities.

Strategic Alliance The CFL strategic alliance

is an established leader in blockchain, finance, and banking technologies. CFL intends to sign a service agreement with Coinfirm.io regarding KYC / AML (Anti Money Laundering) inspection for each token holder application. Ambisafe is a pioneer in blockchain technology and ICO offer companies that help the world become more decentralized since 2010. Their work is very important in projects such as Tether and Bitfinex. Recently Ambisafe is behind the success of ICO like. Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines.

is an established leader in blockchain, finance, and banking technologies. CFL intends to sign a service agreement with Coinfirm.io regarding KYC / AML (Anti Money Laundering) inspection for each token holder application. Ambisafe is a pioneer in blockchain technology and ICO offer companies that help the world become more decentralized since 2010. Their work is very important in projects such as Tether and Bitfinex. Recently Ambisafe is behind the success of ICO like. Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines.

Market Plans

CFL Initial Coins Offer

Offering CEY Token in Saint Vincent & Grenadines is being made dependent on exceptions under the Securities Act. The CEY Tokens offered here (and any non-voting shares in CFL Ltd. owned by Nominee) may not be sold to others in accordance with other offers in Saint Vincent & The Grenadines unless the terms of the FSA are met.

The CFL shall provide a Memorandum of Bid to be prepared solely for use by a prospective CFL investor, to be issued by the CFL. The Offer Memorandum shall be prepared in connection with a private offer to an accredited investor, an individual who will be required to verify the status of their accredited investor through other required questionnaires and documentation, and other individuals globally eligible to participate in the jurisdiction in which they reside

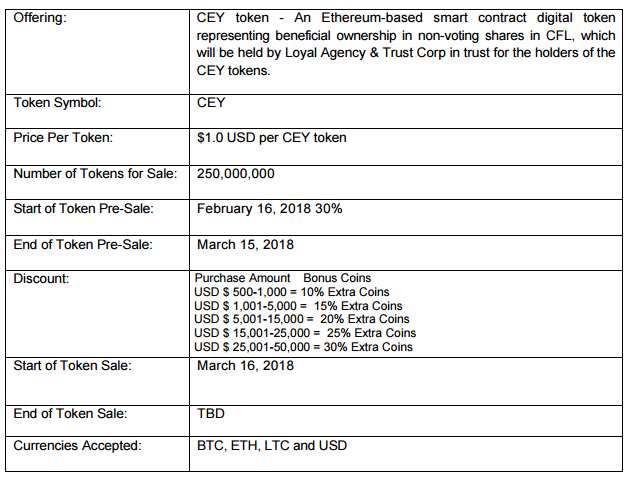

** Offer Summary **

Technical Bidding Mechanism

Potential investors will be required to obtain personally identifiable information when creating an account at ceyron.io to participate in the sale. This information is to ensure compliance with various securities laws in the United States and foreign jurisdictions, as well as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

For US investors, they must fulfill the obligations announced under "accredited investors" standards in accordance with Rule D, Section 506 (c) of the Securities Act. An investor may indicate that they qualify as an accredited investor by supporting and uploading documents in ceyron.io as outlined in the following section "Participation in Bidding."

Participation in the Offer

The offer for a potential US investor is limited to accredited investors as defined in Regulation D under the Securities Act, which means that only persons or entities enter into one or more of the following categories:

- Each bank, as defined in Section 3 (a) (2) of the Securities Act, or other savings and loan associations or other institutions defined in Section 3 (a) (5) (A) of the Securities Act, whether acting in an individual capacity or fiduciary; any brokerage agent registered pursuant to Section 15 of the Exchange Act; any insurance company, as defined in Section 2 (13) of the Securities Act; any investment company registered under the Investment Company Act of 1940 or a business development company, as defined in Section 2 (a) (48) of the Act; any Small Business Investment Company licensed by the US Small Business Administration under Section 301 (c) or (d) of the Small Business Investment Act of 1958; a plan established and administered by a country, its political subdivision or a body or legislation of a State or a political subdivision for the benefit of its employees, if the plan has total assets of more than five million USD ($ 5,000,000); and any plan of employee benefit in the sense of the Employee Income Tax Code of 1974, if the investment decision is made by the plan in fiduciary terms, as defined in Section 3 (21) of the Act, namely bank, savings and loan associations, or registered investment advisor, if the employee benefits program has a total asset of more than five million USD ($ 5,000,000) or, if an independent plan, with an investment decision made solely by the person who is an accredited investor (s);

- Any private business development company as defined in Section 202 (a) (22) of the Investment Advisory Act of 1940;

3) Any organization described in Section 501 (c) (3) of the Internal Revenue Code of 1986, as amended, corporate, Massachusetts or similar business confidence, or enterprise, not formed for the sole purpose of acquiring Common Stock, assets of more than five million USD ($ 5,000,000);

- Every director or executive officer of the Company;

- Any natural person whose net worth, or net worth, together with that person's spouse, excludes the principal amount of the person's primary residence from the mortgage and other liens, when his purchase exceeds one million USD ($ 1,000,000);

- Any natural person who has an individual income of more than two hundred thousand USD ($ 200,000), or a combined income with that person's spouse exceeds three hundred thousand USD ($ 300,000), in each of the last two years and who reasonably expects to achieve the same level of income in the current year;

- Any trust with total assets exceeding five million USD ($ 5,000,000), is not formed for the specific purpose of acquiring Common Stock, whose purchases are directed by a sophisticated person as described in Rule 506 (b) (ii) (ii) of the Regulations D; or

- Any entity whose equity owner is accredited by an investor

To invest in this Offer, an investor needs to first create an account and register at <a href-"www.ceyron.io"> www.ceyron.io. Under Section 506 (c) of the Securities Act, evidence of accreditation status is required to be invested. This can be satisfied during the account creation process by completing the accreditation process in one of three common behaviors:

- Accreditation by Investor's Earnings

- Accreditation based on Investor's Net Assets

- Third Party Verification Letter

- Pair Securities Offering and Transfer Restrictions

The CEY Token is offered and issued to persons other than an American dependent on Rule S under the Securities Act. Each Customer Token CEY will be deemed to represent, guarantee and agree as follows:

- Either that: an "accredited" investor (as defined in Rule 501 of Regulation D under the Securities Act); or not "U.S. people" and obtaining CEY Tokens under "offshore transactions"

- If Customer is an acquirer in transactions occurring within the United States, you acknowledge that until the deviation of the Lock-Up Period you will not be allowed to offer, sell or transfer the CEY Token and that after that date you will not become allowed to sell or transfer the CEY Token to other US Persons unless they sell all of their CEY Tokens to a Person.

- If Customer is an acquirer in transactions occurring outside the United States pursuant to the Regulatory Rules, you acknowledge that you may not sell or transfer any CEY Token at any time to the United States or to any account or advantage of US Person in the meaning of Rule 902 under the Securities Act . However, Non-US Persons may sell CEY Tokens to other foreign investors in Offshore Transactions pursuant to Rules 903 and 904 under the Securities Act and are subject to applicable law in other jurisdictions.

- The CEY Token will not be sold to others according to other offers in Saint Vincent & The Grenadines unless the terms of the FSA are adhered to.

- Customer acknowledges that the CFL will not be required to accept registration of the removal of any CEY Token obtained from it, except when providing satisfactory evidence to the CFL that the limitations set forth herein have been complied with.

Reporting and Transparency for Investments

Fund NAV Reporting

CFLs intend to publicly report the Net Asset Value (NAB) of the IMF on a monthly and quarterly basis on the CFL website.

Fund NAV Reporting

CFLs intend to publicly report the Net Asset Value (NAB) of the IMF on a monthly and quarterly basis on the CFL website.

NAV Methodology Calculation

NAV = (accrued net interest - net loss incurred) / (principal amount + total cash)

NAV = (accrued net interest - net loss incurred) / (principal amount + total cash)

NAV per CEY Token will be calculated by dividing the NAV by the number of CEY Tokens in circulation on the date of calculation rounded to the nearest cent. The number of CEY tokens in circulation is calculated as the number of CEY Tokens issued and circulated, less the ones exchanged by CFLs.

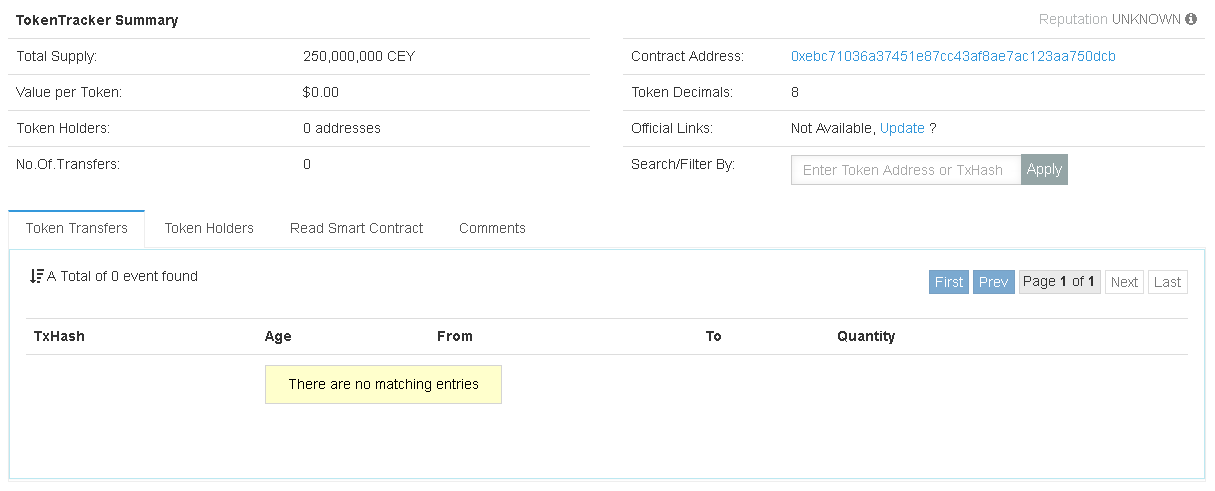

Ceyron Token

Use of Results

The CEY Token Fund will be used to provide the following funds:

RISK FACTORS

General Business Risks

In the event of economic downturn, the company's business plans, revenue generating capabilities, and overall solvency may be risky. Early enterprise firms are generally very risky, and the possibility of business failure regardless of the overall business climate is possible.

Certain Business Risks

Vehicle investment has various inherent risks, which may result in: (i) loss of overall investor capital, (ii) less than targeted investment returns, or (iii) less than expected liquidity, among others.

Vehicle investment has various inherent risks, which may result in: (i) loss of overall investor capital, (ii) less than targeted investment returns, or (iii) less than expected liquidity, among others.

Credit Risk

There is no guarantee that the Fund's investment objectives will be achieved and investors will not suffer losses. To reduce the risk of substantial credit losses, CFLs will take appropriate credit loss allowances, which will be imposed on each asset in accordance with our credit policy guidelines, consistent with ordinary financial institutions that invest in similar credit assets.

There is no guarantee that the Fund's investment objectives will be achieved and investors will not suffer losses. To reduce the risk of substantial credit losses, CFLs will take appropriate credit loss allowances, which will be imposed on each asset in accordance with our credit policy guidelines, consistent with ordinary financial institutions that invest in similar credit assets.

Portfolio Risk

There is a risk that CFLs can not achieve targeted results. CFL portfolio coupons and returns are critical to our ability to drive consistent dividends to token holders and continue to reinvest our portfolio, thereby increasing the value of our portfolio and sustainable tokens.

There is a risk that CFLs can not achieve targeted results. CFL portfolio coupons and returns are critical to our ability to drive consistent dividends to token holders and continue to reinvest our portfolio, thereby increasing the value of our portfolio and sustainable tokens.

CFLs may not be able to achieve the desired level of leverage on their portfolio at the cost of the desired debt. Thus, there is a risk that net portfolio returns to investors may not be met. In such CFLs intend to take advantage of secured senior leverage, risks to investors can be enhanced by the existence of a senior guarantee liens on portfolio assets.

The Liquidity Risk Token The CEY Token

may not reach the desired level of liquidity, so its liquidity is less than the investor expected.

may not reach the desired level of liquidity, so its liquidity is less than the investor expected.

Risk of Regulation The

failure of the CFL to obtain prior regulatory authorization in the territory of the jurisdiction already in operation or the regulator's refusal to grant such authorization in a jurisdictional area that may wish to operate may prevent the CFL from maintaining or expanding its business. Further, amendments to laws or regulations, including the promulgation of new requirements relating to laws, advertising, internet, or online commerce (or changes in the applicability or interpretation of existing regulations or laws by regulators or other authorities), in jurisdiction where CFLs are currently running a business, may require CFLs to stop doing business, or modify how to conduct business in those jurisdictions. Such changes may also negatively impact the CFL business, financial condition,

failure of the CFL to obtain prior regulatory authorization in the territory of the jurisdiction already in operation or the regulator's refusal to grant such authorization in a jurisdictional area that may wish to operate may prevent the CFL from maintaining or expanding its business. Further, amendments to laws or regulations, including the promulgation of new requirements relating to laws, advertising, internet, or online commerce (or changes in the applicability or interpretation of existing regulations or laws by regulators or other authorities), in jurisdiction where CFLs are currently running a business, may require CFLs to stop doing business, or modify how to conduct business in those jurisdictions. Such changes may also negatively impact the CFL business, financial condition,

<h2Your Privacy and Security

All data provided to us is stored in a secure computing environment protected by a secure firewall to prevent unauthorized access. The company controls access so that only the person who needs to access the data of the investor is granted access. All CFL team members are provided with security training and are required to comply with a set of security policies, procedures and security standards related to their work.

All data provided to us is stored in a secure computing environment protected by a secure firewall to prevent unauthorized access. The company controls access so that only the person who needs to access the data of the investor is granted access. All CFL team members are provided with security training and are required to comply with a set of security policies, procedures and security standards related to their work.

CFL Management Team

Counselor

Executive management

Website: https://ceyron.io/

Whitepaper: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Link:https://bitcointalk.org/index.php?action=profile;u=1929500

Tidak ada komentar:

Posting Komentar